If you want to offer faster consumer services and collect payments quickly in your business banking account, you must explore embedded finance (EmFi).

Retail and consumer appliance storefronts are not just selling goods and services. They are also delivering the next-generation shopping experience to customers. Today, customers can buy a product, get a line of credit to buy the product, and insure it at the same time with a single click. That is the power of EmFi. To know more, keep reading.

What Is Embedded Finance?

Embedded finance integrates financial services, products, and technologies with non-financial businesses. It enables businesses to sell products or services quickly in their physical and online stores by integrating payments, lending, monthly payments, loyalty points, and so on in an app or online software.

In EmFi, the non-finance business is the face of the industry. Real players are at the backend. For example, behind every embedded finance product is a financial software development company that ties up with the banks and the non-finance businesses.

The most famous example of EmFi is the buy now pay later (BNPL), where consumers can check out a product without paying any cash. They would just enter their SSN, loan account number, etc. The seller’s marketplace will quickly link the data with an embedded finance service provider who will secure a loan from a partner bank.

Here, the following happens:

- The buyer gets a product without paying now; they’ll pay later

- The seller sells a product to a qualified buyer

- The financing institution is able to get a new customer

- A financial software developer embeds all these activities in one software

EmFi cuts unnecessary paperwork and bank visits for retail transactions. Also, businesses can sell additional financial products to their customers and earn commissions. For example, a car retailer sells car insurance along with a car.

Types of Embedded Finance

Find below the different types of embedded finance you should know about:

#1. Embedded Banking

One of the most common types of EmFi is embedded banking. Startups and online businesses often sign up for business banking from fintech companies like Mercury Bank, Revolut, Wise, etc.

These fintech SaaS providers create and distribute software where businesses can open new banking accounts, deposit revenue earnings, invest, take loans, and so on. The fintech company provides a digital platform for all these transactions. At the backend, there is a real bank that provides banking and financial services.

#2. Branded Payment Cards

These are credit or debit cards backed by banks but branded for businesses. For example, Apple Card comes with an Apple logo on a titanium card with your name on it. You get the maximum benefit when combining it with your iPhone and also get cashback and loyalty points in one wallet. Apple lets you buy Apple hardware in installments when you use Apple an Card.

#3. Embedded Insurance

For conventional insurance, you would have to buy a product and visit an insurer to see if they want to insure the product or not. But fintech changed the way how the insurance industry operates. Nowadays, you can almost insure everything provided you buy the product from a reputed online or offline store.

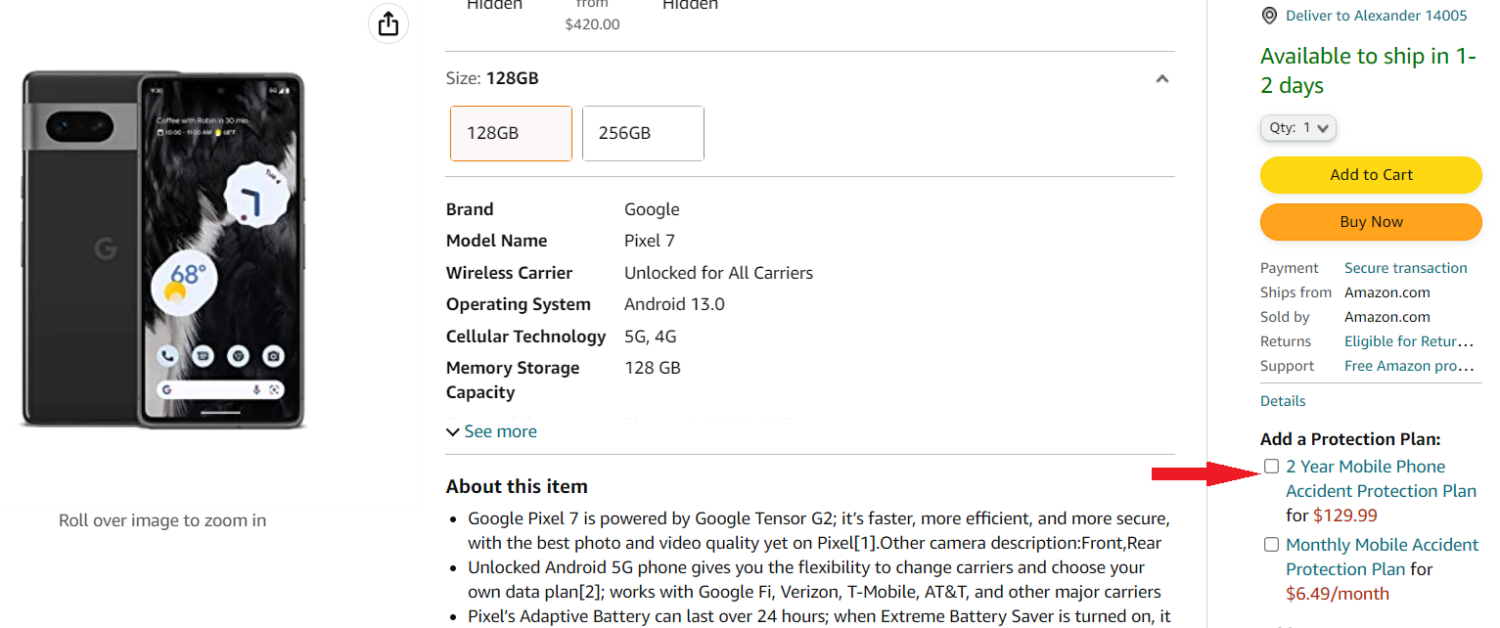

For example, when you buy Pixel 7 from Google Store, you can choose Google Preferred Care as insurance for the Pixel 7 phone or even get an accidental protection plan when you purchase it on Amazon.

#4. Embedded Lending

In embedded lending, online and physical marketplaces tie up with certain banks and financial institutions for consumer loans. When a customer approaches the retailer, they can choose to get a loan approved by the partner bank. Thus, consumers do not pay upfront but promise to pay later.

#5. Embedded Payments

In EmFi and fintech, embedded payments is a system where you can save your credit card, debit card, or mobile wallet information in the online marketplace or mobile app of the seller. When you need to buy something, you just select the payment mode and check out. Embedded payments offer a convenient buying experience where customers do not need to enter card numbers manually.

Who Distributes Embedded Finance?

If you implement an efficient embedded finance system, it does not matter which business you are in. You can distribute EmFi services provided your business has the necessary digital infrastructure and customer footfall.

For instance, if you are a popular local diner operator and you have got a couple of restaurants throughout the city, you can start with the following EmFi products:

- Branded payment cards for your diner

- Loyalty points for using your card

- Offer insurance services for small items like mobile phones, laptops, tablets, etc.

Currently, the following businesses and entities are the leaders in EmFi distribution:

- Any online or physical retailers

- Software and mobile app developing companies

- Telecom companies

- Online marketplace aggregators

- Digital wallets

- Original equipment manufacturers

How to Use Embedded Finance Efficiently

Find below high-quality resources to learn advanced theories of EmFi:

Increase Digital Footprint

The success formula behind EmFi is how popular your business is. Therefore, you need to market your brand using websites, social media pages, groups on social messaging platforms, and more.

Ensure you are routing the social media traffic to your website and eCommerce platforms by providing appropriate deep links. If you own physical stores, you can promote those on your social media marketing campaigns.

Online Business Payments

Push for payments using various online payment gateways that also reward you with a loyalty bonus. Not to mention, such payments are instant and highly secure compared to offline payments. Check-out experience and convenience are also high with online payments.

Roll Out Branded Cards

You can offer discounts, cashback, and loyalty points to encourage your customers to enroll for a payment card from your business. Payment cards could be prepaid or postpaid. Prepaid is beneficial for you since the customers would deposit a bulk amount for the whole month. This is guaranteed revenue for the entire month.

Promote Financial Products

Whether you sell groceries, hardware, or niche services, you can always promote financial services offered by partner banks or wealth management agencies. Also, embed financial products like mobile phone insurance, cryptocurrency exchange, equity trading, travel insurance, flight insurance, and more into your checkout cart.

How Can Embedded Finance Change the Fintech Industry?

EmFi is already helping the fintech industry to grow rapidly. According to Vantage Market Research, the fintech industry earned over $133 billion in revenue between 2017 and 2022. The research firm expects that the revenue will increase by up to $556 billion by 2030. At the same time, EmFi adoption increased proportionately. Find below the avenues of fintech that EmFi will directly influence and transform:

Increasing Consumer Spending

Fintech enables lenders to approve short-term credit lines electronically by verifying customer credentials like SSN, credit score, etc., online. Thus, consumers do not need to visit lenders’ offices to get a line of credit.

However, fintech has limited reach. It can barely reach the target audience. Here, EmFi can help lenders and fintech developers. Retailers can install EmFi systems in their online and offline checkout systems to promote insurance, financial, and banking products. This practice increases customer spending more easily than other marketing tactics.

Enhancing Payment Security and Convenience

Apple Pay and Google Pay (Google Wallet) are the best examples of secure payments online with convenience and spending rewards.

With Apple Pay and Apple Card, compatible Apple device users can pay online and offline. At offline stores, they can simply use NFC or a touch-and-pay system. There is no need to take out the card and swipe.

Apple Card holders get an instant line of credit for Apple product purchases in the Apple Store and on Apple.com. Furthermore, by syncing the card with your iPhone, you can pay on almost any online marketplace. Not to mention, the card earns you unlimited 3% cashback.

There are similar branded cards available from Delta Air Lines, Citi, Hilton Honors, Hotels.com, Amazon Prime Rewards, Costco Anywhere Visa, and so on.

Banking as a Service (BaaS) by Fintech

Startups need an all-in-one solution that can cater to capital inflow deposits, customer payment deposits, employee payments, vendor payments, and surplus capital investments. Since startups operate globally, they also require seamless foreign exchange in different currencies.

Today’s advanced fintech businesses like Novo, Relay, Wise, Revolut, LendingClub, NorthOne, etc., are offering exactly what the startups need. These are BaaS services providers empowered by embedded financial services.

If there were no EmFi, startups would have to invest more time in physical banking, wasting time and money.

Benefits of Embedded Finance

There are multifaceted benefits of the EmFi concept, and these are as below:

- Customers can purchase products and services conveniently

- Consumers can also invest in high-quality financial instruments without visiting banks or wealth manager firms

- Retailers can increase their product sales by offering short-term unsecured term loans

- Any business can diversify its revenue-earning sources by selling add-on financial products

- Fintech startups and software development companies can earn revenue to reinvest in EmFi technology development

- Governments and financial regulators can create a cash-free digital economy easily

Challenges of Embedded Finance

The primary challenge to the growth of EmFi is customer apathy to online payments. Still, a large chunk of consumers prefers to pay using currency notes. They are also unfamiliar with the integrated financing system and prefer real banks and fencing agencies over virtual banking. Some other notable challenges are:

- Various financial regulations imposed by governments and central banks

- Many banks do not have API access to their systems, enabling fintech startups to sell EmFi products and services.

- Consumer, retailer, and banking data security

Future Scope or Embedded Finance

Provided that flawless data security and data encryption are in place, EmFi will make banking and financing more accessible. Banks and financial agencies will have to spend less on marketing and product promotion.

For example, Amazon is already providing various shopping cards from different banks. When users opt for such payment cards, it actually increases the customer base of the underlying banks.

According to Juniper Research, embedded financial services revenue could reach $183 billion by 2027 in the global market. Therefore, there is a lot of financial scope for non-finance businesses, software developers, technology startups, lenders, and banks.

Embedded Finance Learning Resources

#1. Fintech: Buy Now Pay Later (BNPL) | Udemy

Are you a fintech mobile app developer or online marketplace owner looking to increase revenue? You must learn how the BNPL system works by signing up for this Udemy course.

Buy now, pay later is one of the most popular unsecured and short-term borrowing systems among consumers. The course will shed light on BNPL concepts like the following:

- BNPL and its market scope

- BNPL business model and consumer behavior

- Offline and online transactions using BNPL

#2. Understanding FinTech | Udemy

If you wish to learn EmFi, you must know the basics of financial technology by completing this quick and self-paced learning module on FinTech Basics. Udemy crafted the course content in a way that everyone could understand. You will learn fintech concepts like the following:

- Fintech and financial stability

- FinTech’s Ecosystems

- FinTech’s Scope

#3. Fintech: Embedded Finance, Payments, BaaS, and API Banking | Udemy

EmFi relies on advanced banking and financial technologies like API banking, online document verification, software integration, and a lot more. You can learn all these by signing up for this Embedded Finance course on Udemy. Major course content is as outlined here:

- Banking as a service

- API banking

- Embedded payments

#4. Embedded Finance: When Payments Become An Experience

Your learning journey of EmFi will be incomplete if you do not learn the past, present, and future from this Embedded Finance book.

| Preview | Product | Rating | Price | |

|---|---|---|---|---|

|

Embedded Finance: When Payments Become An Experience | $21.98 | Buy on Amazon |

The book discusses how tech giants like Google and Amazon have become the leading enterprises to implement EmFi in their storefronts. It also discusses other examples from startups and niche retailers doing well in EmFi fintech.

Conclusion

Embedded financial technology and services are the next big thing for the retail and BFSI industry. By knowing the technical concepts of EmFi you can diversify your retail revenue sources, increase your customer base, or secure a high-paying job in the BFSI sector. Pick the above online certifications and learning resources to acquire a functional knowledge of EmFi.